child tax credit november 2021 direct deposit

In some cases the advance payments now could lead to a lower tax refund or. If they filed a tax return in 2019 or 2020 and had direct deposit the family started receiving the first 3300 of the credit in six monthly payments of 550 from July to December.

Revised Child Tax Credit Everything You Need To Know Ramsey

600 in December 2020January 2021.

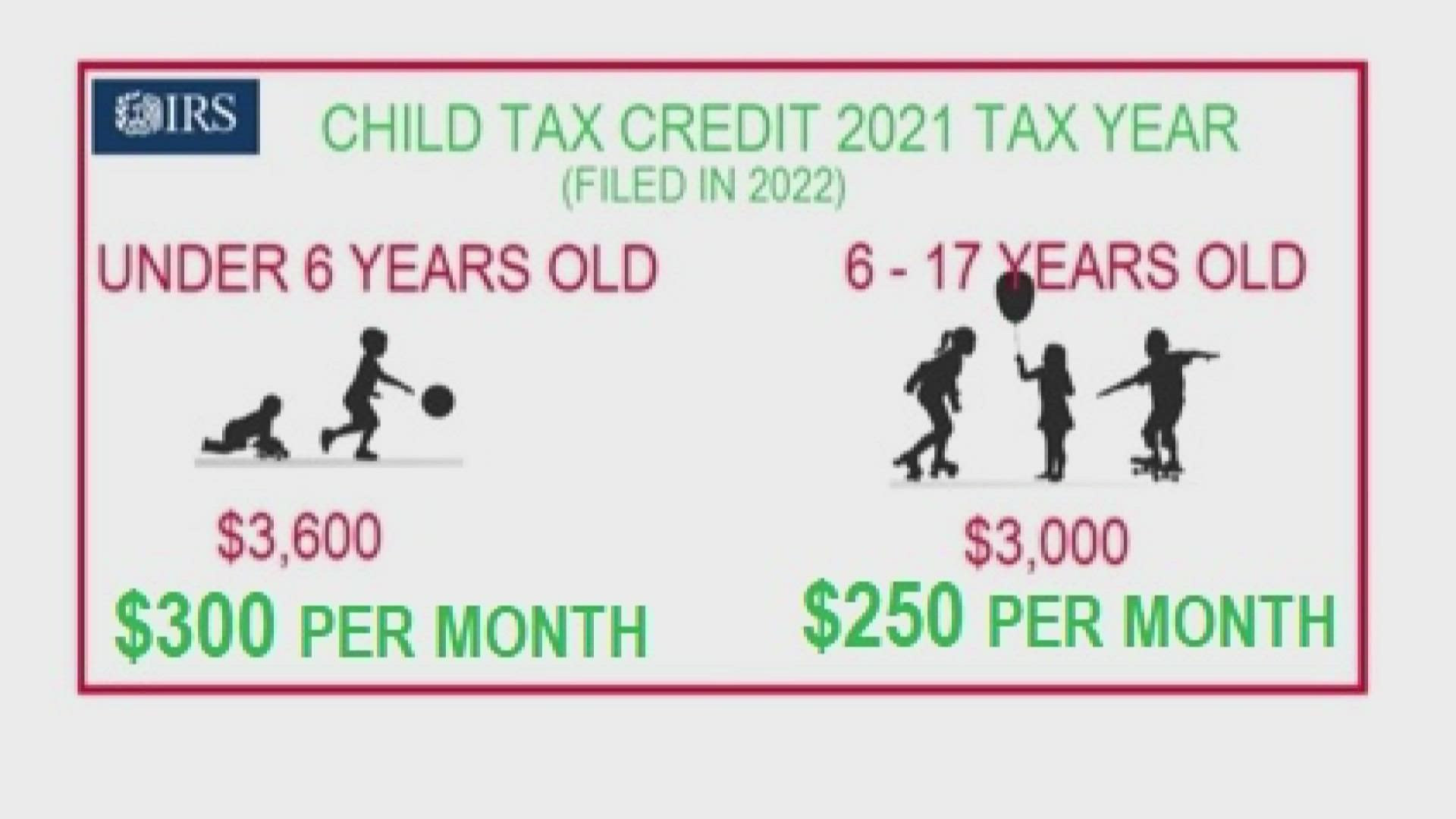

. Under the expanded credit low- and middle-income parents can expect to receive. Nearly 90 percent of advanced Child Tax Credit payments were paid through direct deposit. The majority of the payments worth up to 300 per child will be issued by direct deposit.

The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. August 13 September 15 October 15 November 15 and December 15. Households making less than 12500 and married couples making under 25000 can turn in a simplified tax return via a website the federal government built for the child tax.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. With direct deposit families can access their money more quickly. The fifth payment date is Monday November 15 with the IRS sending most of the checks via direct deposit.

However you can claim the creditworth up to 3600 per childin 2022 by filing. Tax returns processed by June 28. Visit ChildTaxCreditgov for details.

By Dan Clarendon. Eligible families with children 17 years old or younger will get their first Child Tax Credit payments by direct deposit. Payments were posted on the 15th of every month from July to December or earlier when the.

And you will need to take these payments into account when you file your 2021 tax return next year. The deadline to sign up to receive advance Child Tax Credits payments in 2021 was November 15 2021. Ad Receive the Child Tax Credit on your 2021 Return.

November 12 2021 1126 AM CBS Chicago. The IRS will soon allow claimants to adjust their. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

The IRS is relying on bank account information provided by people. Single parents earning up to 75000 a year and couples earning up. 13 2021 Published 330 pm.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. Review the Guidelines and Steps to Apply for the. The agency is tapping bank account information provided through.

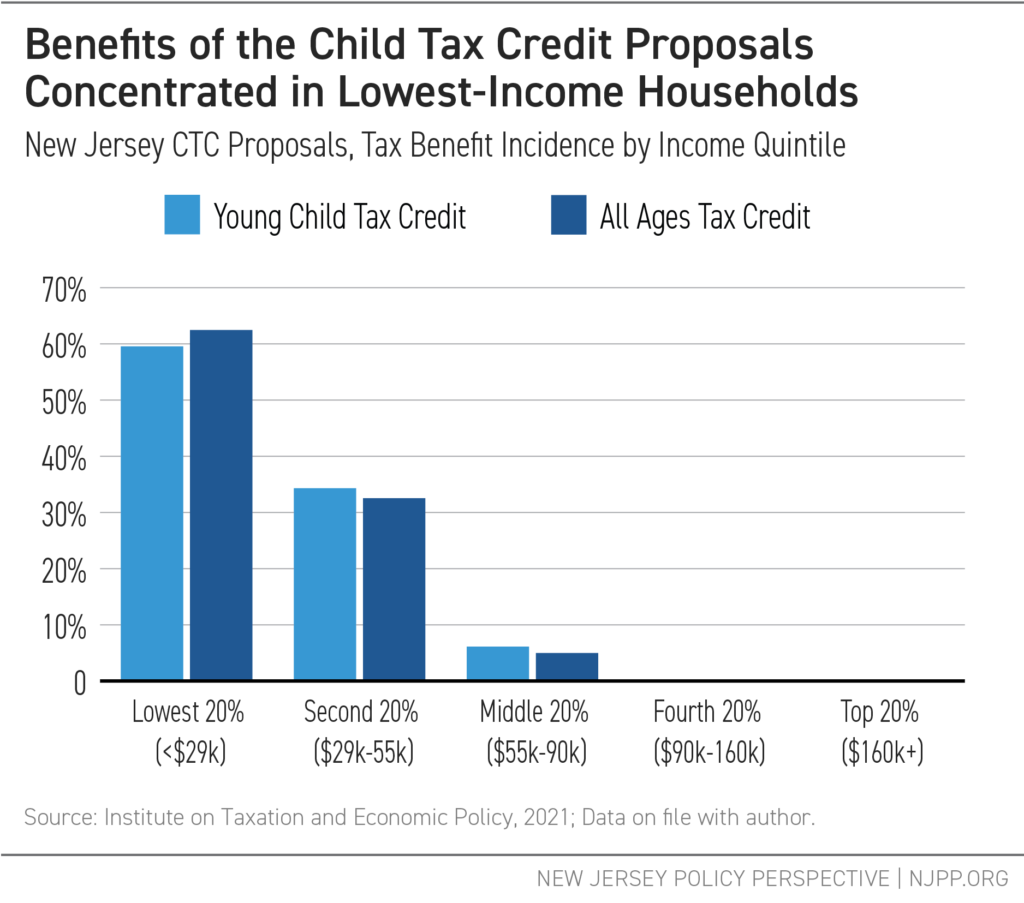

The tax credit provides families with 3600 total per child under age 6 and 3000 total per child ages 6 to 17. It is key to the Bidens.

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Child Tax Credit S Extra Help Ends Just As Covid Surges Anew The New York Times

Thousands Of Ohio Kids Could Miss Out On A Brighter Future Policy Matters Ohio November 08 2021

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Wcnc Com

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Is Your Family Eligible For The Child Tax Credit Payments Legal Aid Of Nebraska

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Childctc The Child Tax Credit The White House

Child Tax Credits 2021 Blackhawk Community Credit Union

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 What To Know About New Advance Payments

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back